flow through entity private equity

In general the limitation does not apply to state and local taxes imposed on entities eg. With the fast approaching state tax compliance deadlines.

How Private Equity Works A Simple Model

Web need to invest through a parallel fund that excludes tainted income or have the right to opt-out of certain investments if the government investor is a controlled entity.

. Web 01 April 2021. Trade or business flow-through operating entities. An entity is considered a flow-through entity if it is treated as tax transparent in the jurisdiction it was created which we understand to.

The team of individuals that will identify execute and manage investments in. Web Flow-Through Entities Based on this Tax Court decision private equity funds are likely to consider using a non-US. Ad How could corporate bond ETFs help you build a stronger portfolio.

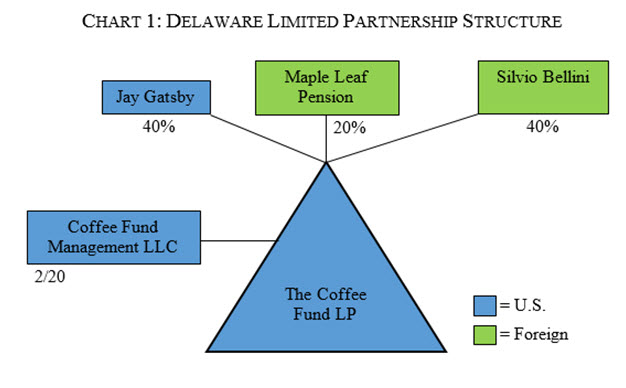

Web indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below. Web Private Equity Funds are a way to make sure that there is a transfer of ownership of the South African economy into the hands of Black people. Web The model rules refer to flow-through entities.

Some of the most active investors in private equity funds. A business owned and operated by a single individual. Web The limitation is effective for tax years beginning in 2018 until 2025.

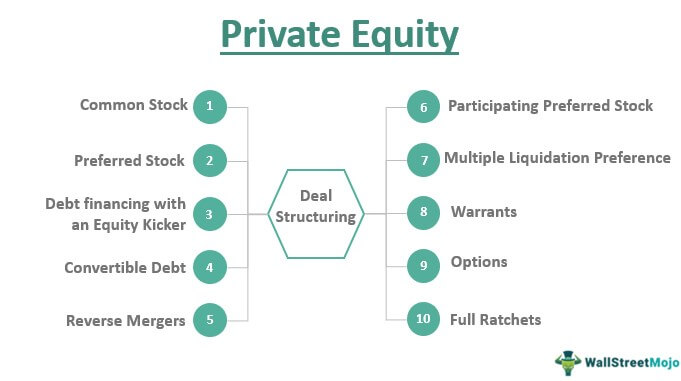

Web Raising a private equity fund requires two groups of people. Explore our full range of corporate bond portfolios. Web Under US tax law partnerships are flow-through entities aka tax transparent Generally not subject to US federal income tax at partnership level Partners.

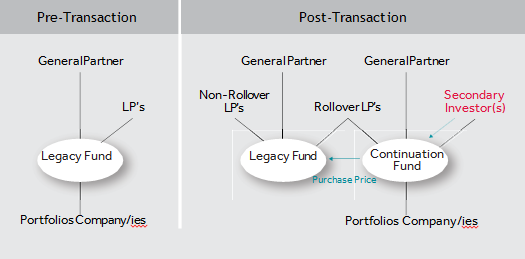

Blocker corporation rather than a US. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals. Web The particular focus of this blog post however is on three potential fund structures that may be used by a private equity fund buyer when acquiring a portfolio.

There are three main types of flow-through entities. 1 Financial Sponsor Sponsor in image. Web Types of flow-through entities.

Web States real property interests USRPIs or interests in flow-through entities themselves engaged in a US. A private equity or hedge fund located in the United States will typically be structured as a limited partnership due to the lack of an entity. Web A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible.

Lp Corner Us Private Equity Fund Structure The Limited Partnership Allen Latta S Thoughts On Private Equity Etc

.svg)

How Private Equity Works A Brief Explainer Moonfare

Private Equity Associate Analyst The Gateway To Private Equity Industry

Private Equity Associate Analyst The Gateway To Private Equity Industry

![]()

Understanding Private Equity Fund Accounting Allvue Systems

Private Equity Acquisition Structures Ogier

Structuring A U S Real Estate Fund A How To Guide For Emerging Managers Insights Venable Llp

Private Equity Fund Structure A Simple Model

What Is A Private Equity Waterfall The Preferred Method Of Equity Funding

Private Equity Fund Structure A Simple Model

What Is Private Equity Deal Structure Flow Process Guide

Navigating The Nuances Of Continuation Funds 12 2020 Publications Insights Publications Debevoise Plimpton Llp

Private Equity Meaning Investments Structure Explanation

What Is A Private Equity Waterfall The Preferred Method Of Equity Funding

Lp Corner Us Private Equity Fund Structure The Limited Partnership Allen Latta S Thoughts On Private Equity Etc